How to understand the hierarchy of human needs, and integrate the concept into the working place?

Have you already heard about the pyramid or hierarchy of needs by Maslow?

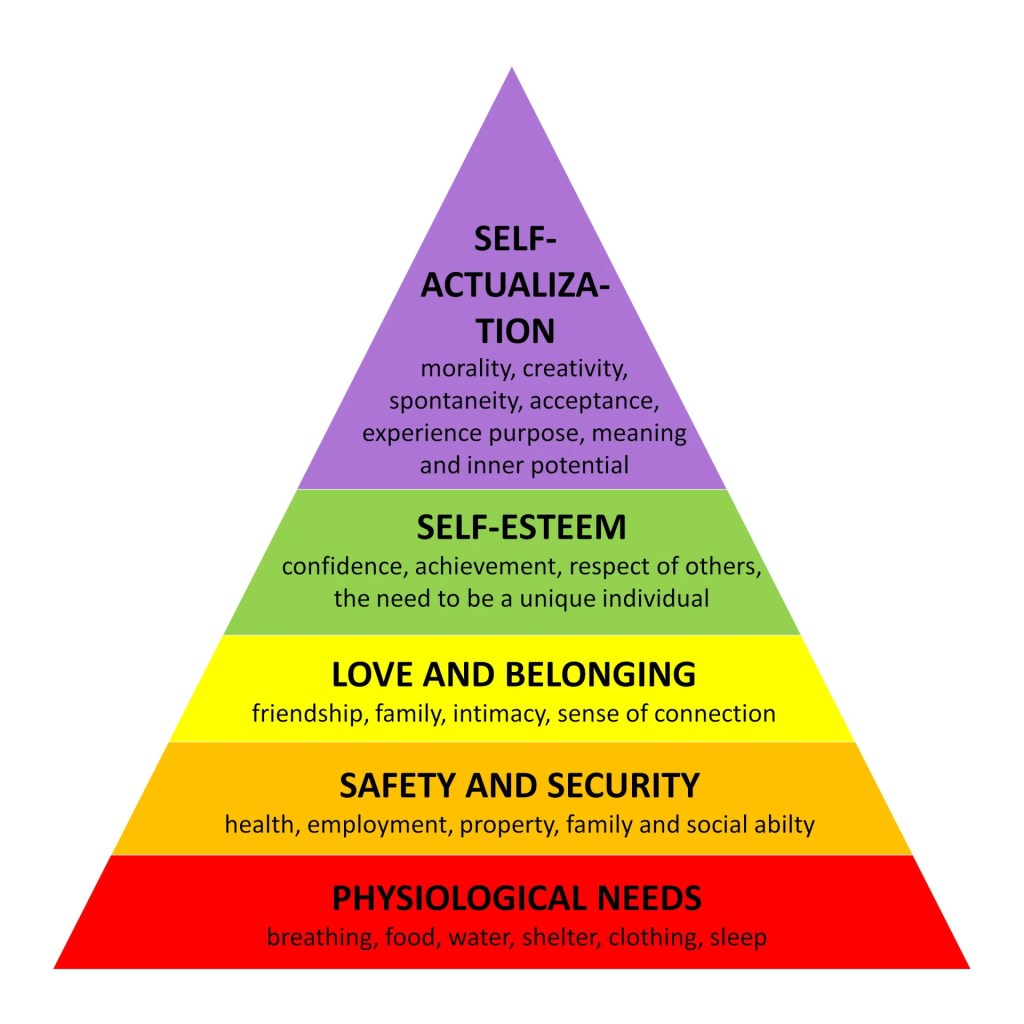

Written by Abraham Maslow, an american psychologist, in 1943, the theory presents a framework suggesting that human motivation stems from a hierarchy of five fundamental categories:

- physiological,

- safety,

- love,

- esteem,

- self-actualization

The theory posits that as individuals progress through these needs, they experience a greater sense of fulfillment and motivation.

Maslow argued that survival needs must be satisfied before the individual can satisfy the higher needs. The higher up the hierarchy, the more difficult it is to satisfy the needs associated with that stage, because of the interpersonal and environmental barriers that inevitably frustrate us.

Higher needs become increasingly psychological and long-term, rather than physiological and short-term, as in the lower survival-related needs.

Even if Maslow’s theory is not widely accepted today, I always found it relevant and used it a lot in the professional field.

In human ressources management for example, it can be effectively applied to motivate employees, improve job satisfaction and foster organizational commitment. Once you understand the concept, you can easily tailor HR strategies to adress each level, enhancing employee well-being and productivity.

We will see how it is worthy of interest in the family office frame.

How does it apply to HNWI?

Being born into wealth can, paradoxically, pose challenges for achieving self-actualization, the highest level of Maslow’s hierarchy of needs.

While wealth can provide the resources to meet the lower levels of the pyramid (physiological, safety, love/belonging, and esteem needs), it may create unique obstacles for individuals striving to reach their fullest potential.

Here are a few key reasons why:

- Lack of motivation or drive,

- Lack of purpose or direction,

- Fear of failure,

- Identity crisis and external validation,

- Lack of adversity and personal growth,

- Dependence on wealth for self-worth,

- Inherited roles and lack of autonomy,

Wealth can create psychological and emotional barriers to reaching self-actualization. The absence of struggle, pressure from societal expectations, and lack of a clear personal identity can prevent wealthy individuals from fully realizing their potential and finding meaning and purpose in life.

Overcoming these barriers often requires self-reflection, genuine personal goals, and a willingness to step outside of the comforts that wealth provides.

How can the family office help?

Family offices can play a critical role in helping wealthy individuals, by not only managing their financial resources but also guiding them toward personal fulfillment and long-term growth.

Achieving self-actualization involves understanding one’s true potential, passions, and goals beyond material wealth.

Here’s how we can support this journey:

Facilitating goal discovery and purpose alignment

– Explore Personal Values: Through deep conversations and reflection exercises, we can help clarify core values, passions, and interests, leading to the identification of meaningful, long-term goals.

– Develop a Personal Vision: Developing a life vision that goes beyond financial success, focusing on areas like career fulfillment, personal growth, philanthropy, and legacy-building.

– Link Financial Strategy to Purpose: Structure financial plans that align with the client’s passions, whether through philanthropic endeavors, impact investing, or supporting projects that reflect their personal values.

Encouraging personal growth and education

– Facilitating Access to Learning Opportunities: We can guide toward educational programs, seminars, and personal development courses that align with goals and interests. This might include leadership programs, coaching, or even formal education in areas the person is passionate about.

– Mentorship and Networking: Introduce HNWI to thought leaders, mentors, or coaches who can inspire them and help them explore their full potential in business, philanthropy, or other personal endeavors.

– Supporting Passion Projects: Encourage to invest time and resources in projects that challenge the person, such as starting a business, engaging in creative arts, or funding research in areas that intrigue them.

Encouraging philanthropy and legacy building

– Identify Meaningful Causes: Work with the person to explore philanthropic causes that resonate with their values and personal history, and can provide a sense of purpose and contribution to the world.

– Establish Charitable Trusts or Foundations: Help the person set up foundations, charitable trusts, or donor-advised funds to support long-term, sustainable philanthropy that aligns with their vision for impact.

– Create a Legacy Plan: Assist in crafting a legacy that reflects the individual’s contributions to society beyond financial inheritance, ensuring that they leave behind an impactful and enduring footprint.

Promoting risk-taking and autonomy

– Encourage Entrepreneurial Ventures: Motivate the person to pursue entrepreneurial projects that challenge them creatively and strategically, whether through startups or investments in areas that spark curiosity and passion.

– Foster Independent Decision-Making: Rather than solely managing the wealth, a good family office encourages the UHNWI to be an active participant in financial and life decisions, which builds autonomy and personal responsibility.

– Provide a Safety Net: By securing the family’s core financial well-being, we can provide the confidence and safety net for the person to take calculated risks in new endeavors without the fear of losing their wealth or status.

Navigating family dynamics and identity challenges

– Facilitate Family Conversations: Help navigate family expectations regarding the use and management of wealth, ensuring that the individual’s personal goals are not overshadowed by inherited roles or family pressures.

– Develop Personal Identity Beyond Wealth: Encourage individuals to define their self-worth beyond financial assets by focusing on personal achievements, passion projects, and meaningful contributions to society.

– Wealth Transition Planning: Assist with wealth transition strategies that support the client’s desire for independence and personal legacy, rather than simply maintaining inherited wealth structures.

As a matter of conclusion, a family office can go beyond traditional financial management to become a true life strategist, playing a transformative role in helping individuals and families achieve the highest level of Maslow’s pyramid.

Happy to read your thoughts about this subject. Feel free to share, comment, or send me an email.

Laisser un commentaire