How family offices can promote this mindset when, in fact, there is actually a lot to lose?

During the last weeks, I have been hearing this phrase a lot : « You have nothing to lose! »

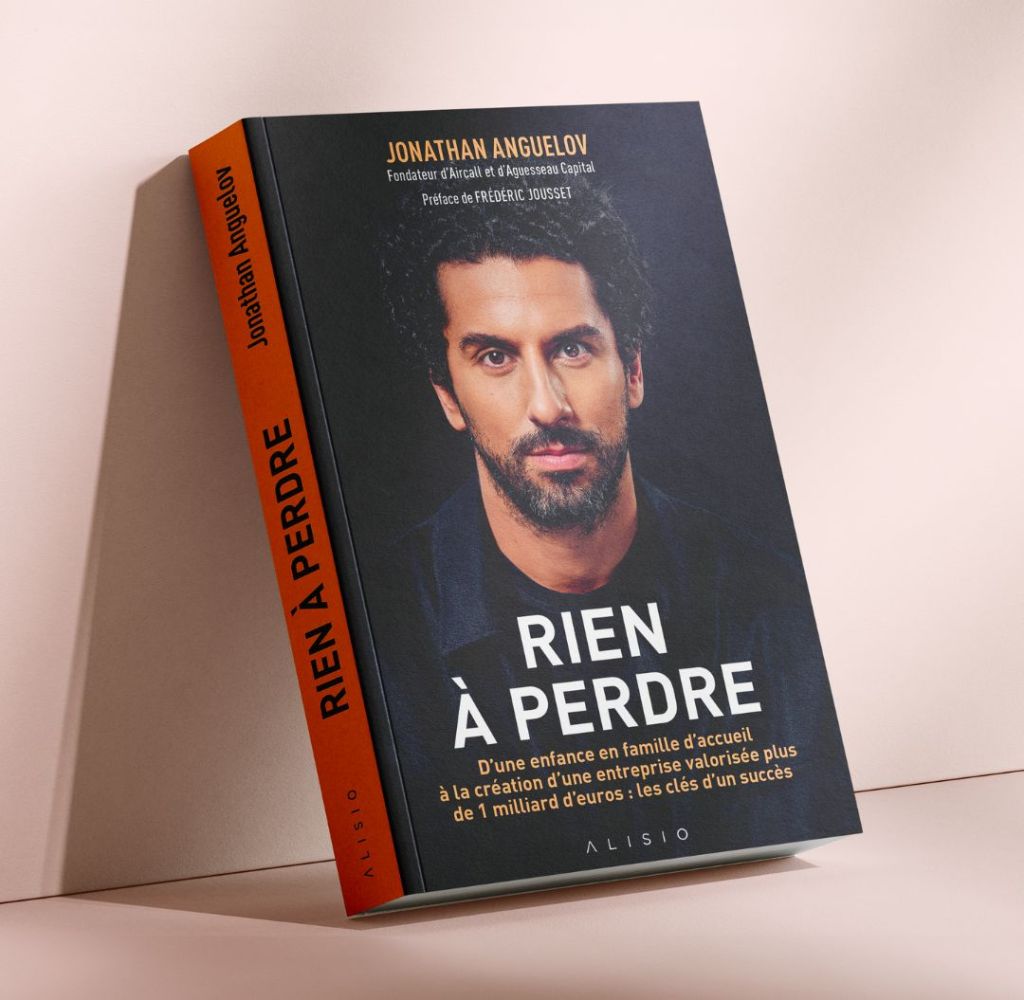

A few days ago, I read a post on LinkedIn from successful tech and real estate entrepreneur Jonathan Anguelov about the new release of his book titled « Nothing to lose« .

It had me thinking about it.

When you grow up poor, it is pure resilience to embrace your condition and go ahead with what life throws at you, driven by this truth : I have nothing to lose!

It is likely that life’s hardships give us a certain freedom from the fear of failure and a willingness to take calculated risks in hope of better outcomes.

For someone with wealth, and especially born into wealth, cultivating a similar mindset requires a different approach since they do have tangible assets at stake.

The key distinction is that while someone from modest condition might have had external circumstances creating that mindset naturally, someone with wealth needs to cultivate it intentionally through their perspective and values.

Wealth is not about having a lot of money; it’s about having a lot of options.

During many years working with UHNW individuals and families, I found different techniques or approaches that can help develop a version of this mindset.

Here is my top 5, and what a family office can do about it :

- Compartmentalization : Separating specific ventures or projects from the overall wealth, mentally allocating only what they’re truly willing to risk.

Creating formal structures that separate high-risk investments from core wealth preservation, establishing a dedicated « innovation fund » or « venture allocation » with clear boundaries (e.g., 5-10% of total assets), complete with its own performance metrics and governance, can be a good idea. This separation helps psychologically fence off risk capital, pursue opportunities more boldly within defined parameters while ensuring the family’s lifestyle and legacy assets remain protected. - Purpose-driven focus : Shifting focus from potential losses to meaningful purpose or impact, which can override fears about financial consequences.

The family office should facilitate deep discovery sessions to uncover the family’s core values and purpose beyond wealth preservation. Introducing impact investment opportunities aligned with one’s personal mission, is a good path to explore. By quantifying both financial and purpose-driven returns, we help reframe decision-making criteria from purely wealth protection to meaningful legacy creation, enabling bolder action toward what truly matters. - Identity separation : Distinguishing their core identity and self-worth from their wealth or material possessions.

A thoughtful family officer might introduce practices that help individuals distinguish their personal worth from their net worth, such as creating family constitutions that articulate values independent of wealth, facilitating regular « wealth psychology » sessions, or encouraging participation in communities where the individual’s expertise rather than wealth defines their contribution. Structuring philanthropic activities that connect family members with people from diverse backgrounds, broadening their identity beyond wealth, is also an enriching process. - Calculated courage : Making decisions based on potential upside, with clear boundaries on what they’re willing to risk.

It might be interesting to develop sophisticated scenario planning models that clearly illustrate the actual (versus perceived) impact of potential losses against the family’s overall wealth picture. We can create decision frameworks that prioritize asymmetric opportunities—where limited downside exists alongside significant upside potential. I found providing data-driven perspectives on true risk exposure can help families overcome emotional risk aversion and pursue promising opportunities coupled with appropriate commitment. - Beginner’s mindset : Consciously approaching situations with the curiosity and openness of someone starting fresh.

A common approach is to deliberately expose the individuals to unfamiliar domains where their wealth confers no particular advantage. It is possible to arrange learning journeys into emerging markets, wilderness travels, new technologies, or social contexts outside one’s experience. Don’t forget to bring in diverse outside perspectives—entrepreneurs from different backgrounds, next-generation thinkers, or experts from adjacent fields—to challenge assumptions and encourage fresh thinking.

I am convinced family office professionals should keep in mind that wealth can either constrain or liberate us, depending on our relationship with it, and meaningful risk-taking comes from connection to purpose rather than circumstances alone.

Laisser un commentaire