This article was written initially in French, and has been translated to English with the help of AI. You can read the original version here :

As the world of family offices becomes increasingly publicized and known to a wider audience, we are witnessing a big transformation of this industry, one that was originally, and by nature, discreet and protected.

For some time now, service providers, wealth managers, all kinds of specialists, and various advisors have been multiplying in the field and across social media.

While this evolution is both inevitable and necessary to modernize, refresh, and challenge the family office in its practices, this influx is not without risk for the families involved.

Indeed, many of those attracted to this environment are either motivated by access to wealth they believe will come easily, or they are fascinated by the mysterious opacity behind which families tend to remain hidden.

In both cases, these newcomers are likely to be disappointed.

And in both cases, they pose a threat to the families whose wealth or prestige they covet.

If you are here as a professional for either of these reasons, you are in the wrong place.

If you’re not entirely sure, it’s time to question your deeper motivations.

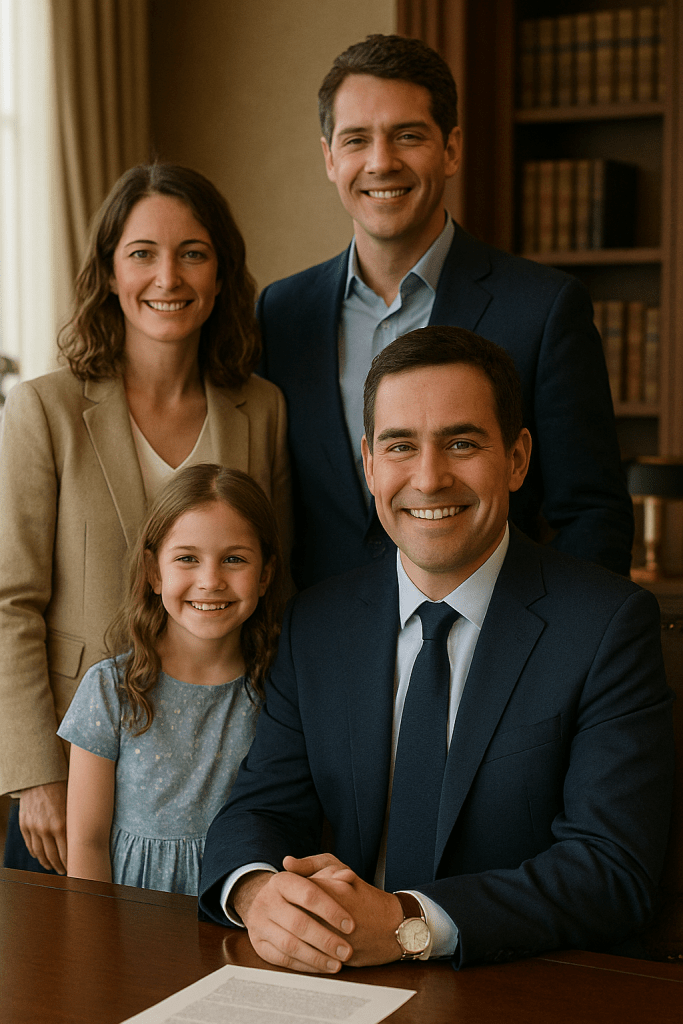

Mom, why do you only work for rich people?

That’s the perfectly legitimate and innocent question my daughter once asked me, and it’s probably the best question anyone has ever asked me in this field.

I don’t see myself as particularly drawn to money, and my background and experience have made me very hard to impress.

In fact, having shared the daily lives of families in confined environments (yachting) has completely dispelled any fascination I might have had about the nature of UHNW family relationships.

So yes, why, my daughter?

I usually answer that I love families. I love the very notion of legacy, heritage, shared history, and continuity. In the novels I write, families and their unique dynamics are always at the heart of the story.

But why the wealthy?

It took quite a bit of introspection to be able to answer that question, and the answer comes down to two things :

Seeing money as a tool in the service of a vision

Scientists agree that tools are not exclusive to Homo sapiens. However, the invention of the first tools plays a decisive role in the history of the human species.

Without tools, we are left with ideas, hard to implement. A tool, whatever it may be, allows us to act, to execute, to bring to life what we have imagined or dreamed of. That is exactly how I see money: a tremendously effective tool, yes, but a tool, and nothing more.

Having grown up in a very modest family myself, I experienced firsthand what the lack of money can produce: stress, anxiety, sadness, guilt…

Poverty often means setting dreams aside simply because there are no means to achieve them.

If you’re a parent obsessed with finding money just to pay the bills and put food on the table, it doesn’t mean you’ll be a bad parent, of course not! But it may prevent you from enjoying peaceful moments with your children, from supporting their development, from providing them with the best conditions to grow.

At the very least, it will be much harder for you than for others. Simply because money is the tool you lack.

By working with wealthy individuals, I have access to tools that allow me to bring to life not only the vision I’ve created for myself, but also the vision these families hold.

Through philanthropy, it even becomes possible to extend the benefits of money beyond the personal and family circle, but that is probably the subject of another article. 😉

Being the architect of that vision

Continuing this reflection, seeing families in possession of all the best possible tools and still failing to achieve their dreams feels inconceivable to me.

Yet, it happens all the time, and it’s precisely what gives rise to the well-known saying: “Money doesn’t buy happiness.” Because money is not enough. Don’t forget, it’s just a tool. It needs people. And people need a plan.

I can’t resist sharing with you one of the most inspiring speeches I know, Martin Luther King’s address to students in Philadelphia in 1967, just months before his death. In it, he speaks about the idea of having a “life blueprint.”

This kind of plan is the only one worth having, because we know full well that life never sticks to the original script.

It’s not about having a rigid, practical roadmap or a predetermined fate, but rather a guiding thread, something to hold onto both when everything’s going well and when everything falls apart.

Equipped with a plan in mind and the right tool in hand, all that remains is to put it all into action.

Easier said than done, of course! And that’s exactly where I find the most meaning in my work.

Sometimes it’s incredibly hard to get things moving, to execute the plan, even when you have all the tools and a clear vision of the end goal.

In those moments, the presence of someone who understands the vision, knows how to use the tools, and can bring the plan to life is absolutely essential.

If I had to explain the different components of a Family Office, I would use this analogy to say that you need:

- A Visionary: the individual or the family

- A Plan: the family’s identity

- Tools: investments, legal advice, different forms of capital…

- An Architect: the executive

Ultimately, it’s the harmony between all these elements that makes it possible to pursue one common goal: the family’s long-term vision.

And remember, no one can serve two masters.

Laisser un commentaire